Are you tired of feeling like your finances are a runaway train? The key to financial freedom might be simpler than you think, and it starts with a well-structured budget.

For many, the mere mention of "budgeting" conjures images of complex spreadsheets, confusing formulas, and a whole lot of number-crunching. The truth is, managing your money effectively doesn't have to be a Herculean task. While the digital age offers numerous tools and applications, the core principles of smart money management remain timeless. This article delves into the world of budgeting, exploring various approaches and offering practical advice to help you take control of your financial future.

In the realm of personal finance, the name Dave Ramsey is synonymous with practical, results-oriented advice. His "Total Money Makeover" and the accompanying principles have guided countless individuals and families toward financial stability. His approach emphasizes debt elimination, disciplined spending, and a focus on building wealth, and at the heart of it is a budget.

- Unraveling Fikfok Tiktok Confusion A Deep Dive

- Movierulz 2025 Your Guide To Telugu Movies More Explore Now

However, the idea of creating your own spreadsheet from scratch, complete with formulas and calculations, can seem daunting to those new to budgeting. The market has many available tools, and a budgeting app like "EveryDollar" simplifies creating a budget and keeping up with your money. The goal remains the same: to take ownership of your personal finances with a budget planner.

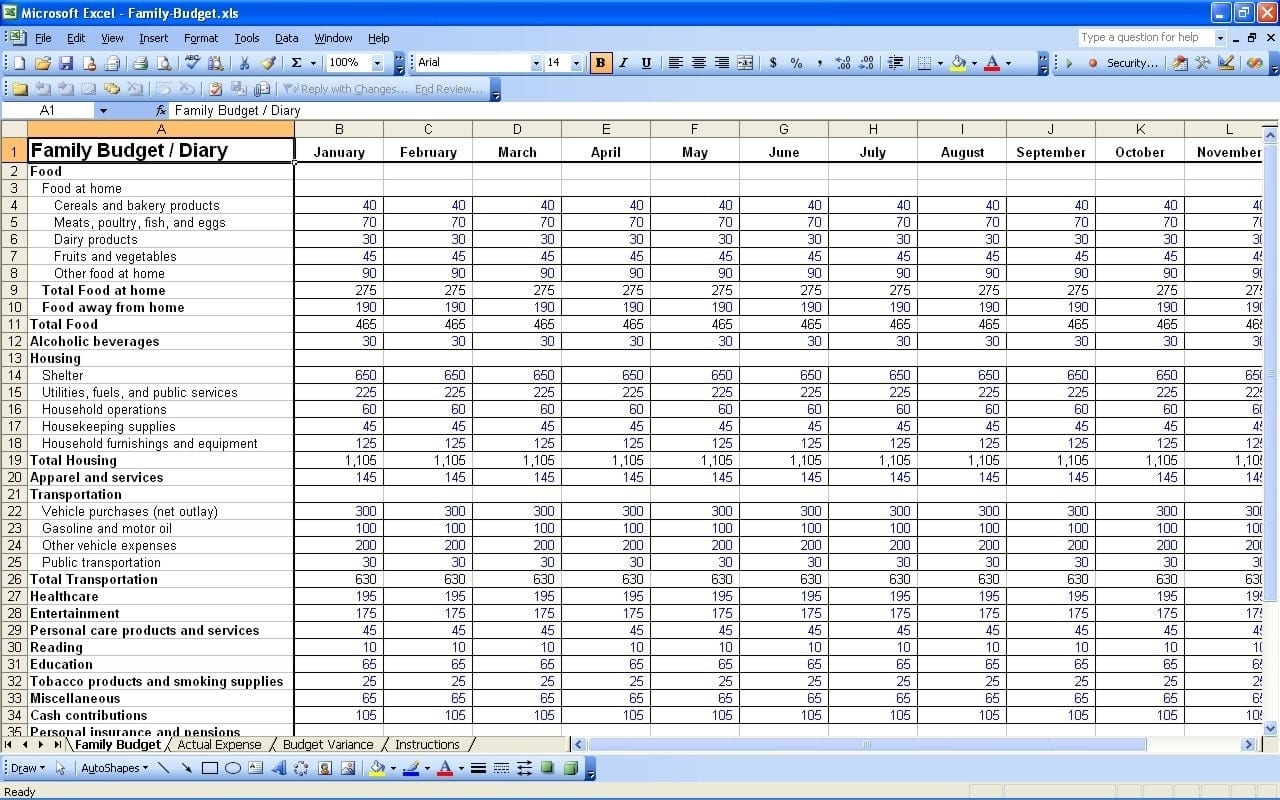

While spreadsheets have their uses, especially if you're comfortable with formulas, there are other options. If youre familiar with spreadsheets, and you're looking for customization, a Dave Ramsey Excel budget template might be just what you need. Several tools even offer customized versions using AI, making the process efficient. A Dave Ramsey Excel budget template essentially takes the proven budgeting principles from the "Total Money Makeover" and translates them into a digital format.

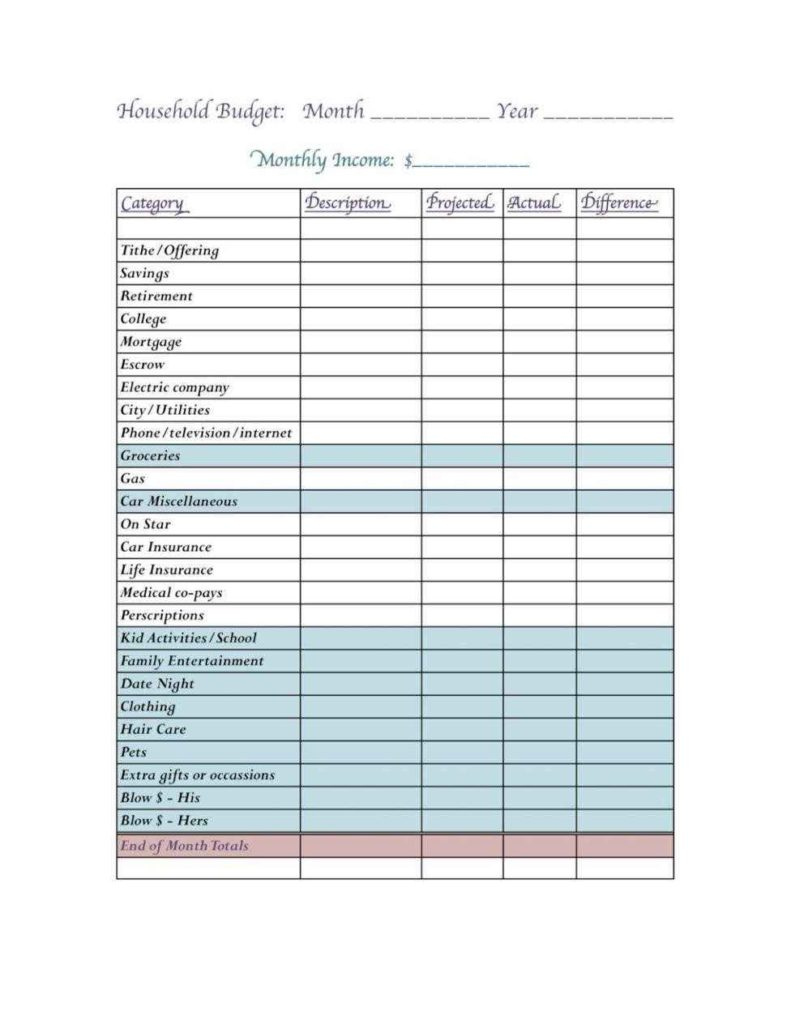

To begin, you will have to determine your income. The best way to figure out your income is by calculating your total monthly income after taxes. Then, you will list all of your expenses, including your debts. By using this information, you can develop a budget where the recommended budget percentages are based on your income and automatically suggests a Dave Ramsey budget.

- Movies Streaming Your Guide To Filmyfly More

- Remembering Patrick Swayze Iconic Moments Last Photo Revealed

One popular method is the "envelope system," where you allocate cash to different expense categories (groceries, entertainment, etc.) each month. Once the cash in an envelope is gone, you're done spending for that category. This system provides a tangible way to track spending and prevents overspending. It provides that feeling of visually seeing the money and what it can get you.

For those who prefer a digital approach, budgeting apps offer an automated and user-friendly way to manage finances. These apps often connect to your bank accounts, automatically categorizing transactions and providing real-time insights into your spending habits. They often incorporate the Dave Ramsey baby steps, offering recommendations.

Regardless of the method you choose, the process typically involves tracking your income, categorizing your expenses, and allocating funds to each category. Budget categories are like folders, with budget lines acting as the files inside. The key is to create a budget that aligns with your financial goals and provides a clear picture of where your money is going each month. For example, you can categorize 'food', 'groceries', and 'restaurants', as budget lines.

When calculating payment amounts for debt, the first step is to calculate how much you're going to pay for the first month of the last debt. Then, take the payments and put them in order, from smallest to the biggest. After you have done this, you can create a debt snowball spreadsheet, where you can see the payments and how they go.

One significant advantage of using a budget, whether a spreadsheet or an app, is that you can clearly visualize your financial situation on a single page. This allows you to have a birds-eye view of your income, expenses, and the money you're saving or allocating to investments.

Here's a quick breakdown of the benefits:

- Awareness: Understanding where your money is going.

- Control: Taking charge of your spending habits.

- Goal-setting: Planning for the future and achieving financial milestones.

- Reduced debt: Identifying areas where you can cut back and eliminate debt.

- Financial freedom: Building wealth and achieving long-term financial security.

Consider the free printable Dave Ramsey budget forms. They are free and will truly help you set up and grow and tackle your budget. This is a great starting point for those new to budgeting and is easy to maintain.

One of the core principles of the Dave Ramsey philosophy is "paying yourself first." This means setting aside a portion of your income for savings and investments before you spend on anything else. The idea is to make saving a priority, rather than an afterthought.

Budgeting isn't just about saving money, it's about saving time. It's about making sure that every dollar has a purpose. A budget helps you allocate money toward what is truly important. You can get an understanding of your finances, so you wont be left wondering where your money went.

Ultimately, the path to financial wellness is a journey, not a destination. It requires discipline, consistency, and a willingness to adapt your approach as your circumstances change. Start by educating yourself. Use budgeting apps, and templates and follow some of the Dave Ramsey baby steps.

Below is a table that presents a comprehensive overview of the various budgeting methods discussed:

| Budgeting Method | Description | Pros | Cons | Best Suited For |

|---|---|---|---|---|

| Spreadsheet Budgeting | Creating a budget using spreadsheet software like Excel or Google Sheets, allowing for customization and detailed tracking. |

|

| Individuals who enjoy a hands-on approach and want complete control over their budget. |

| Budgeting Apps | Using mobile or web applications that automate budgeting by connecting to bank accounts and categorizing transactions. |

|

| Tech-savvy individuals who want an easy-to-use and automated budgeting solution. |

| Dave Ramsey's Budgeting Principles | Following the budgeting methods and baby steps as prescribed by Dave Ramsey, emphasizing debt elimination, disciplined spending, and wealth building. |

|

| Individuals and families looking to eliminate debt and build wealth. |

| Envelope System | Allocating cash to different expense categories and using only the cash in those envelopes for spending. |

|

| Individuals who prefer a hands-on approach and need help controlling spending. |

Before taking your budgeting journey, remember to download everydollar (its free!) and start telling your money where to goone monthly budget at a time.

- Jackermans Mothers Warmth Ch 3 A Heartwarming Tale

- Unveiling Wasmo Telegram Link 2025 Your Ultimate Guide